Tredit IQ Blog

Explore our latest thinking on credit automation, trade finance, and how we're building the future of B2B credit management.

Latest Articles

The Importance of Good Communication in B2B Credit Management

Learn how clear communication from approval to final demand accelerates cash flow, reduces risk & preserves relationships—plus free AI email templates for credit pros.

June 30, 202511 min read

10 Reasons to Have Customers Fill Out a B2B Credit Applicatio

Top 10 reasons every B2B firm should require a customer credit application—reduce risk, cut DSO, protect cash flow, and strengthen customer relationships.

June 25, 20255 min read

What Is a “Good” Time-to-Decision for B2B Credit Applications?

What constitutes a good time-to-decision (TTD) in U.S. B2B credit processes—from submission to approval or denial. It outlines benchmarks for fast, average, and slow turnaround times, highlights industry-specific expectations, and discusses the impact of TTD on sales, customer experience, and internal efficiency. It also offers strategies to reduce TTD without increasing risk.

June 23, 20258 min read

How Modern Digital Credit Applications Help Sales Teams Close Deals Faster

Close deals faster by accelerating customer approvals, increasing visibility into application progress, and eliminating friction between Sales and Finance.

June 11, 20257 min read

How a Well-Crafted Credit Application Can Reduce DSO in B2B Trade Credit

A detailed look at how a well‑designed digital credit application vets customers, tightens terms, and helps B2B companies cut Days Sales Outstanding.

June 9, 20257 min read

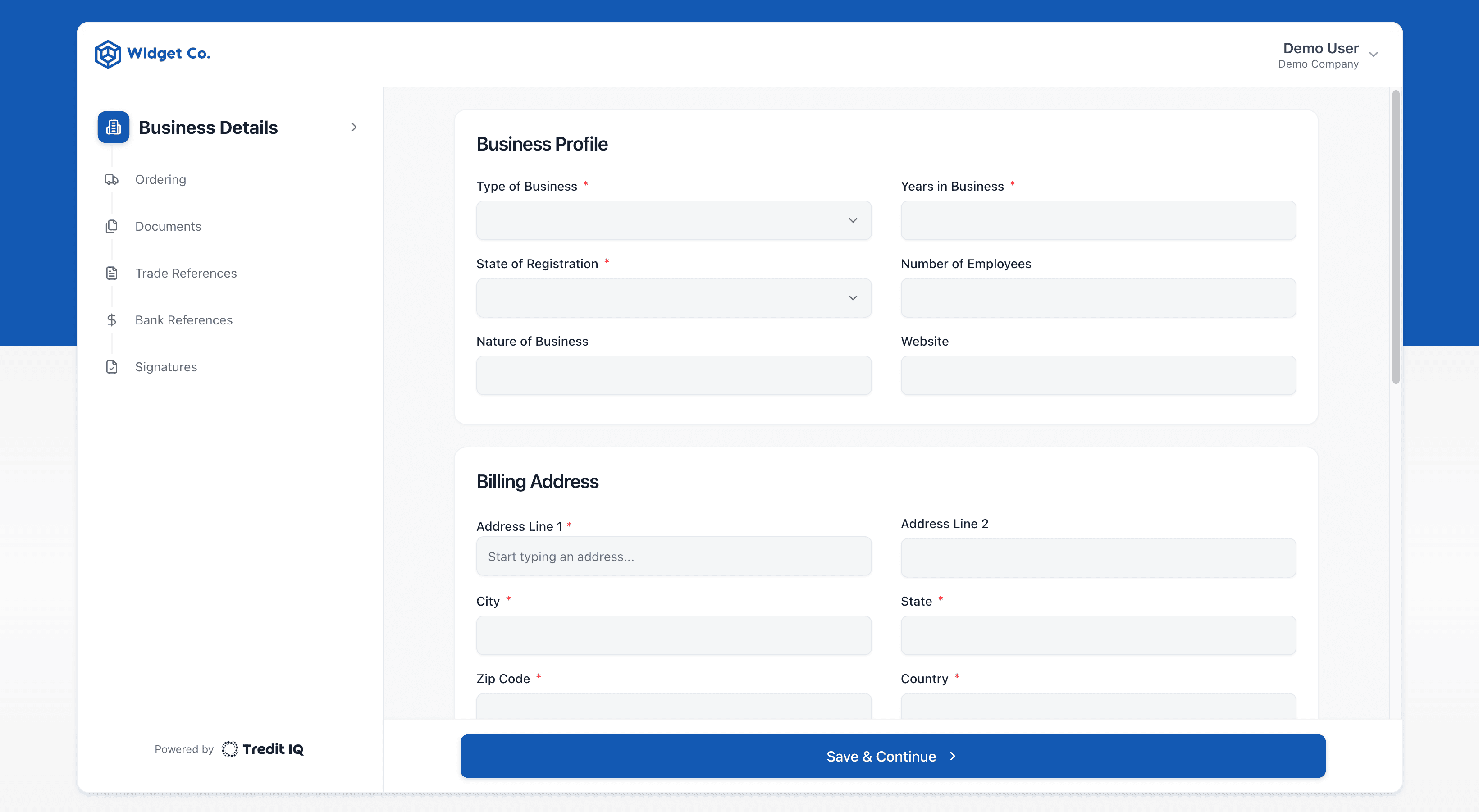

From PDF to Digital: Modernizing Your B2B Credit Applications

Discover why modern credit teams move from PDF to digital apps—faster approvals, cleaner data, mobile ease—and how Tredit IQ’s AI bridges any PDF holdouts.

June 6, 202510 min read

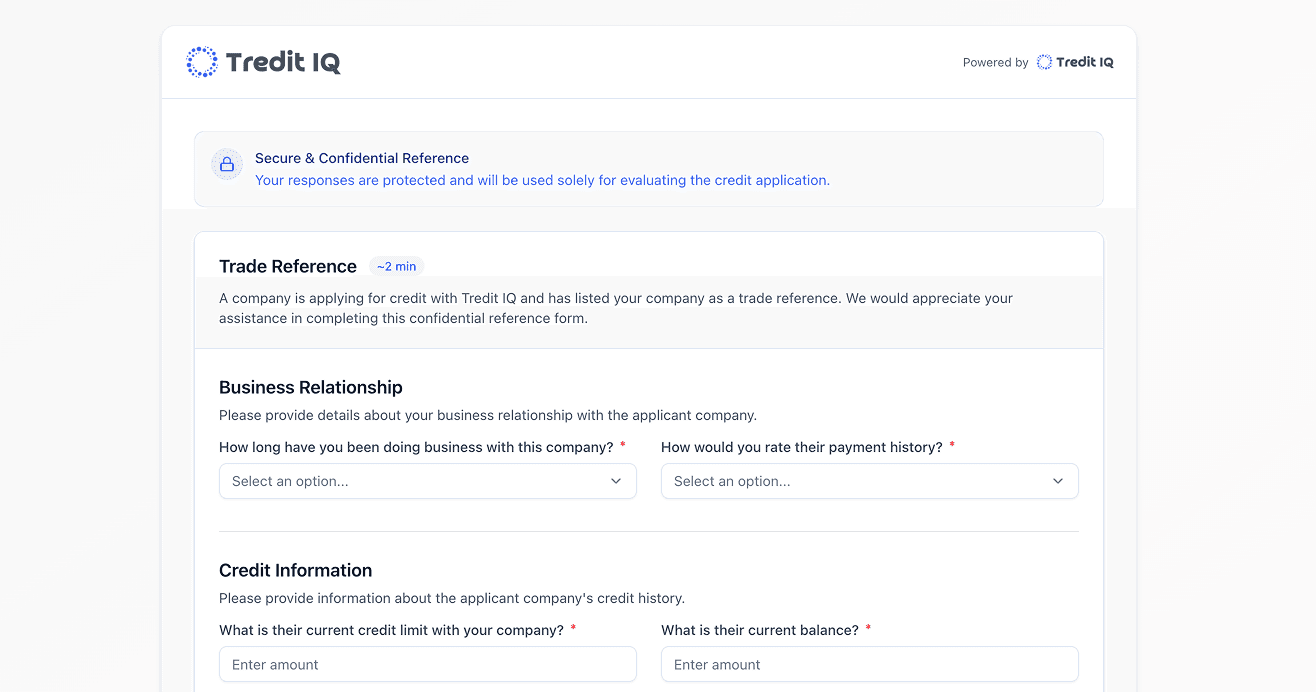

B2B Credit Monitoring: How to Use Trade References for Ongoing Risk Management

Learn how B2B credit managers can turn trade references into a continuous monitoring tool—proactively checking customer payment behavior and strengthening risk oversight.

May 30, 20255 min read

Factoring: De-Risking Trade Credit in B2B Finance

Learn how recourse and non‑recourse factoring convert invoices to cash, transfer credit risk, and strengthen liquidity for credit managers across industries.

May 29, 202510 min read

How to Set Trade Credit Limits & Payment Terms: A Step‑By‑Step Guide for Businesses

Learn how to assess customer risk, calculate safe trade credit limits and set payment terms that boost sales while safeguarding your business’s cash flow.

May 27, 202510 min read

Listen to Our Podcast

Dive deeper into B2B credit and trade finance insights on our podcast. Easily consume the same great content on your favorite podcast platforms.